The 25-Second Trick For Summit Business Advisors Llc

Table of ContentsFascination About Summit Business Advisors LlcIndicators on Summit Business Advisors Llc You Should KnowWhat Does Summit Business Advisors Llc Do?The 8-Minute Rule for Summit Business Advisors LlcThe Definitive Guide for Summit Business Advisors LlcSummit Business Advisors Llc Things To Know Before You BuyThe Best Guide To Summit Business Advisors Llc

A good economic consultant comprehends this and arranges your money in a method that your tax outgo is minimal. An independent monetary expert acts as your hero here.The duty of an independent financial expert requires them to be a dynamic scientist. They are well-updated on various industries, economic markets, risks, existing legislations, taxation guidelines, and various other areas of monetary management.

In a quick and dynamic world, you already have a whole lot on your plate. Despite the fact that you intend to, it is fairly feasible that you find it tough to carve out time from your active timetable for managing your financial resources. With an economic consultant by your side, you can be care-free about your money.

5 Simple Techniques For Summit Business Advisors Llc

While you are functioning, monetary advisors can make your money job for you. They look after a broad range of financial difficulties and obligations on your behalf and locate optimum methods for wealth production. Monetary advisors not just bring years of experience to the table however also have a clear viewpoint.

Financial suggestions can be beneficial at transforming points in your life. Like when you're beginning a household, being retrenched, planning for retirement or handling an inheritance. When you meet a consultant for the very first time, exercise what you desire to receive from the suggestions. Before they make any suggestions, an adviser needs to make the effort to review what is necessary to you.

Firmly insist that you are alerted of all transactions, and that you obtain all communication pertaining to the account. Your adviser may recommend a handled optional account (MDA) as a means of managing your financial investments. This entails authorizing an arrangement (MDA agreement) so they can acquire or sell financial investments without having to contact you.

Summit Business Advisors Llc Can Be Fun For Anyone

Before you purchase an MDA, compare the advantages to the prices and dangers. To safeguard your money: Don't give your adviser power of attorney. Never authorize an empty paper. Place a time limitation on any authority you provide to deal investments on your behalf. Insist all communication about your investments are sent to you, not simply your consultant.

This may take place throughout the meeting or digitally. When you go into or renew the ongoing cost plan with your consultant, they ought to explain how to finish your connection with them. If you're transferring to a brand-new adviser, you'll require to set up to transfer your economic records to them. If you need aid, ask your advisor to discuss the process.

The logical capitalist is anything. On a daily basis, individuals make irrational choices based on feelings not because they aren't clever but due to exactly how they're wired. Behavior finance acknowledges this obstacle and offers monetary advisors the tools they require to help their customers make reasonable decisions when they or else would not.

A Biased View of Summit Business Advisors Llc

This field acknowledges that investors aren't logical which their feelings can affect their financial investment (https://www.anyflip.com/homepage/pwkgr#About) options. Fear, greed, insolence, securing bias, loss aversion and knowledge bias are simply several of the emotional aspects that bring about poor decision-making and suboptimal investment outcomes. By studying financier psychology and recognizing the role of feelings in monetary decision-making, monetary experts can find out more regarding their customers' motivations and supply even more reliable guidance and support.

Both bears will terrify us: One of which is lethal, and the various other is not." You additionally can think of conventional and behavior money as 2 sides: one is typical money (technological and fundamental), and the other is behavioral. You can't have a coin without both sides. Whatever analogy you prefer, financial advisors who comprehend these distinctions can tailor their guidance and methods to better straighten with their customers' demands and choices.

That recognition is just among the benefits of behavioral finance. Here are a few other benefits financial advisors can recognize. When monetary advisors have a deep understanding of behavior financing, they're better outfitted to ask about and recognize their customers' habits, biases, and feelings. With this brand-new understanding, advisors can much better align their suggestions to clients' values, demands, and choices.

The Buzz on Summit Business Advisors Llc

One method experts can deliver continuous worth find out is by recognizing that they're in a partnership with customers, and they should nurture it. By growing these partnerships, advisors can better expect and attend to potential investing mistakes, consisting of psychological choices. And as opposed to marketing clients the simplest or the majority of basic products, economic advisors can uncover customized solutions that also make financial sense.

Financial resources matter, yet that's not the only consideration. Behavioral financing assists consultants focus their connections with customers in depend on and compassion instead of simply dollars, figures and monetary optimization. "Advisors still have a tendency to incline discussing performance and products," says Chuck Wachendorfer, president of circulation at think2perform. "Stand up to need to do so and concentrate on what your customers are worried regarding expense of healthcare, long life and maintaining their way of lives." One means experts can show empathy is by taking a go back.

Indicators on Summit Business Advisors Llc You Should Know

As soon as you have actually grasped the principles, you'll be prepared to assist your clients. Find out extra regarding some of the habits of effective economic consultants.

It won't make anybody smarter, yet it will certainly boost and enhance their accessibility to their intelligence." Clarify your own values and exactly how they align with your method to monetary suggesting. We understand that living out of positioning gives anxiety and dissatisfaction which those are simply some of the elements that trigger emotional responses and inadequate decision-making.

You (and your customers) have alternatives for when, where and how you want to sort via and prioritize your values. Simply as you require to specify your worths, help your clients do the same.

The Facts About Summit Business Advisors Llc Uncovered

Financiers may feel pain taking care of money concerns for a variety of reasonsfrom basic boredom to an absence of time - Deltek Ajera Support. Despite where clients get on this range, consultants can resolve this need by structure and preserving trust. Without this guarantee, a worried client might not believe a consultant that says they get on track to reach their objectives, and a time-deprived client may not hand off jobs

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Seth Green Then & Now!

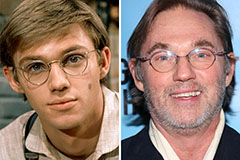

Seth Green Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!